Inflation and Unemployment: Phillips Curve and Rational Expectations Theory!

In the simple Keynesian model of an economy, the aggregate supply curve (with variable price level) is of inverse L-shape, that is, it is a horizontal straight line up to the full-employment level of output and beyond that it becomes horizontal.

This means that during recession or depression when the economy is having a good deal of excess capacity and large-scale unemployment of labour and idle capital stock, the aggregate supply curve is perfectly elastic. When full employment level of output is reached, aggregate supply curve becomes perfectly inelastic.

Inflation-Unemployment Trade -Off: Phillips Curve:

However, the actual empirical evidence did not fit well in the above simple Keynesian macro model. A noted British economist, A.W. Phillips published an article in 1958 based on his good deal of research using historical data from the U.K. for about 100 years in which he arrived at the conclusion that there in fact existed an inverse relationship between rate of unemployment and rate of inflation.

This inverse relation implies a trade-off, that is, for reducing unemployment, price in the form of a higher rate of inflation has to be paid, and for reducing the rate of inflation, price in terms of a higher rate of unemployment has to be borne.

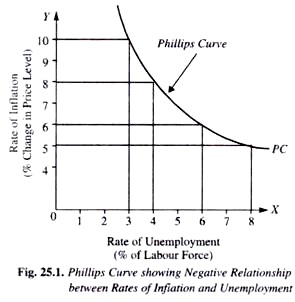

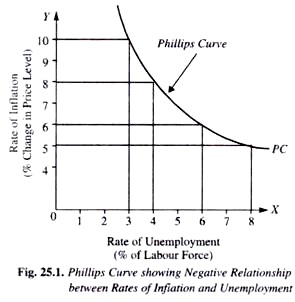

On graphically fitting a curve to the historical data Phillips obtained a downward sloping curve exhibiting the inverse relation between rate of inflation and the rate of unemployment and this curve is now named after his name as Phillips Curve. This Phillips curve is shown in Fig. 25.1 where along the horizontal axis the rate of unemployment and along the vertical axis the rate of inflation is measured. It will be seen that when rate of inflation is 10 per cent, the unemployment rate is 3 per cent, and when rate of inflation is reduced to 5 per cent per annum, say by pursuing contractionary fiscal policy and thereby reducing aggregate demand, the rate of unemployment increases to 8 per cent of labour force.

This Phillips curve is shown in Fig. 25.1 where along the horizontal axis the rate of unemployment and along the vertical axis the rate of inflation is measured. It will be seen that when rate of inflation is 10 per cent, the unemployment rate is 3 per cent, and when rate of inflation is reduced to 5 per cent per annum, say by pursuing contractionary fiscal policy and thereby reducing aggregate demand, the rate of unemployment increases to 8 per cent of labour force.

This Phillips curve is shown in Fig. 25.1 where along the horizontal axis the rate of unemployment and along the vertical axis the rate of inflation is measured. It will be seen that when rate of inflation is 10 per cent, the unemployment rate is 3 per cent, and when rate of inflation is reduced to 5 per cent per annum, say by pursuing contractionary fiscal policy and thereby reducing aggregate demand, the rate of unemployment increases to 8 per cent of labour force.

This Phillips curve is shown in Fig. 25.1 where along the horizontal axis the rate of unemployment and along the vertical axis the rate of inflation is measured. It will be seen that when rate of inflation is 10 per cent, the unemployment rate is 3 per cent, and when rate of inflation is reduced to 5 per cent per annum, say by pursuing contractionary fiscal policy and thereby reducing aggregate demand, the rate of unemployment increases to 8 per cent of labour force.

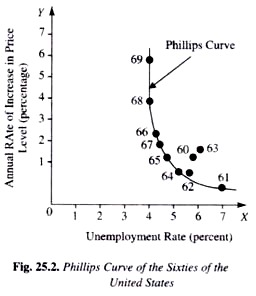

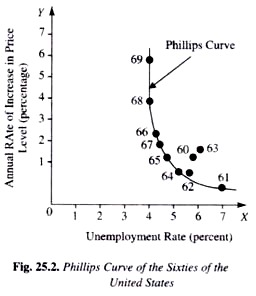

The actual Phillips curve drawn from the data of sixties (1961-69) for the United States also shows the inverse relation between unemployment rate and rate of inflation (see Fig. 25.2). Such empirical data pertaining to the fifties and sixties for other developed countries seemed to confirm the Phillips curve concept. On the basis of this, many economists came to believe that there existed a stable Phillips curve which depicted a predictable inverse relation between inflation and unemployment. Further, on the basis of a stable Phillips curve for a country, they emphasised the trade off that confronts the economic policy makers. This trade off presents a dilemma for the policy makers; should they choose a higher rate of inflation with lower unemployment or a higher rate of unemployment with a low inflation rate.This simultaneous existence of both high rate of inflation and high unemployment rate (or low level of real national product) during the seventies and early eighties has been described as stagflation.

Further, on the basis of a stable Phillips curve for a country, they emphasised the trade off that confronts the economic policy makers. This trade off presents a dilemma for the policy makers; should they choose a higher rate of inflation with lower unemployment or a higher rate of unemployment with a low inflation rate.This simultaneous existence of both high rate of inflation and high unemployment rate (or low level of real national product) during the seventies and early eighties has been described as stagflation.

Further, on the basis of a stable Phillips curve for a country, they emphasised the trade off that confronts the economic policy makers. This trade off presents a dilemma for the policy makers; should they choose a higher rate of inflation with lower unemployment or a higher rate of unemployment with a low inflation rate.This simultaneous existence of both high rate of inflation and high unemployment rate (or low level of real national product) during the seventies and early eighties has been described as stagflation.

Further, on the basis of a stable Phillips curve for a country, they emphasised the trade off that confronts the economic policy makers. This trade off presents a dilemma for the policy makers; should they choose a higher rate of inflation with lower unemployment or a higher rate of unemployment with a low inflation rate.This simultaneous existence of both high rate of inflation and high unemployment rate (or low level of real national product) during the seventies and early eighties has been described as stagflation.

Explanation of Phillips Curve:

Let us first provide an explanation for the Phillips curve. Both Keynesians and Monetarists agreed to the existence of the Phillips curve. The explanation of Phillips curve by the Keynesian economists is quite simple and is graphically illustrated in Fig. 25.3.

It may be noted that Keynesian economists assume the upward-sloping aggregate supply curve. In fact, Keynes himself recognised that the curve AS is upward sloping in intermediate range, that is, as the economy approaches near full employment level, the aggregate supply curve slopes upward.