The accelerator effect also goes the other way: falling GNP (a recession) hurts business profits, sales, cash flow, use of capacity and expectations. This in turn discourages fixed investment, worsening a recession by the multiplier effect.

The accelerator effect fits the behavior of an economy best when either the economy is moving away from full employment or when it is already below that level of production. This is because high levels of aggregate demand hit against the limits set by the existing labour force, the existing stock of capital goods, the availability of natural resources, and the technical ability of an economy to convert inputs into products.

Contents

- 1 Multiplier effect vs. acceleration effect

- 2 Business Cycles vs. Acceleration effect

- 3 Accelerator models

Multiplier effect vs. acceleration effect

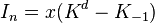

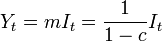

The acceleration effect is the phenomenon that a variable moves toward its desired value faster and faster with respect to time. Usually, the variable is the capital stock. In Keynesian models, fixed capital is not in consideration, so the accelerator coefficient becomes the reciprocal of the multiplier and the capital decision degenerates to investment decision. In more general theory, where the capital decision determines the desired level of capital stock (which includes fixed capital and working capital), and the investment decision determines the change of capital stock in a sequences of periods, the acceleration effect emerges as only the current period gap affects the current investment, so do the previous gaps. The Aftalion-Clark accelerator v has such a form , while the Keynesian multiplier m has such a form

, while the Keynesian multiplier m has such a form  where c is the propensity to consume.

where c is the propensity to consume.

From the above, it can be seen that the change of investment has a multiplier effect on income, but the point that the increase of income accelerates capital accumulation (the acceleration effect increase over time) can only be shown numerically.

increase over time) can only be shown numerically.

Business Cycles vs. Acceleration effect

As the acceleration effect dictates that the increase of income accelerates capital accumulation, and the decrease of income accelerates capital depletion (in a simple model), this might cause the system to become unstable or cyclical, and hence many kinds of business cycle models are of this kind (the multiplier-accelerator cycle models).

Accelerator models

The accelerator effect is shown in the simple accelerator model. This model assumes that the stock of capital goods (K) is proportional to the level of production (Y):

- K = k×Y

- In = k×ΔY

Modern economists have described the accelerator effect in terms of the more sophisticated flexible accelerator model of investment. Businesses are described as engaging in net investment in fixed capital goods in order to close the gap between the desired stock of capital goods (Kd) and the existing stock of capital goods left over from the past (K-1):

Obviously, ceteris paribus, an actual fall in output depresses the desired stock of capital goods and thus net investment. Similarly, a rise in output causes a rise in investment. Finally, if the desired capital stock is less than the actual stock, then net investment may be depressed for a long time.

In the Neoclassical accelerator model of Jorgenson, the desired capital stock is derived from the aggregate production function assuming profit maximization and perfect competition. In Jorgenson's original model (1963), there is no acceleration effect, since the investment is instantaneous, so the capital stock can jump.